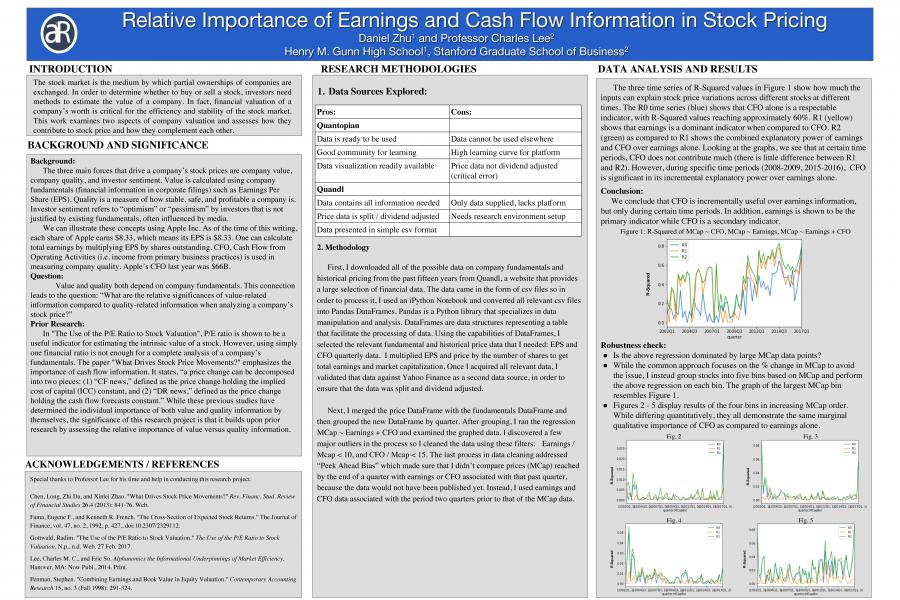

Summary

This research project will be investigating the relationship between a company's cash flow from operations and its future earnings in order to determine whether the market under appreciates the CFO variable. There will be two parts to this investigation. 1. In setting the stock price of a company, does the market consider CFO an incrementally "value-relevant" piece of information, after it already has a company's reported earnings? The idea is to run a regression of the S&P500 firms' stock prices, and put both its Earnings and its CFO on the right-hand-side of the equation. The results may answer this question by looking at the estimated coefficient on the CFO variable, and assess its statistical significance by looking at the t-statistic.