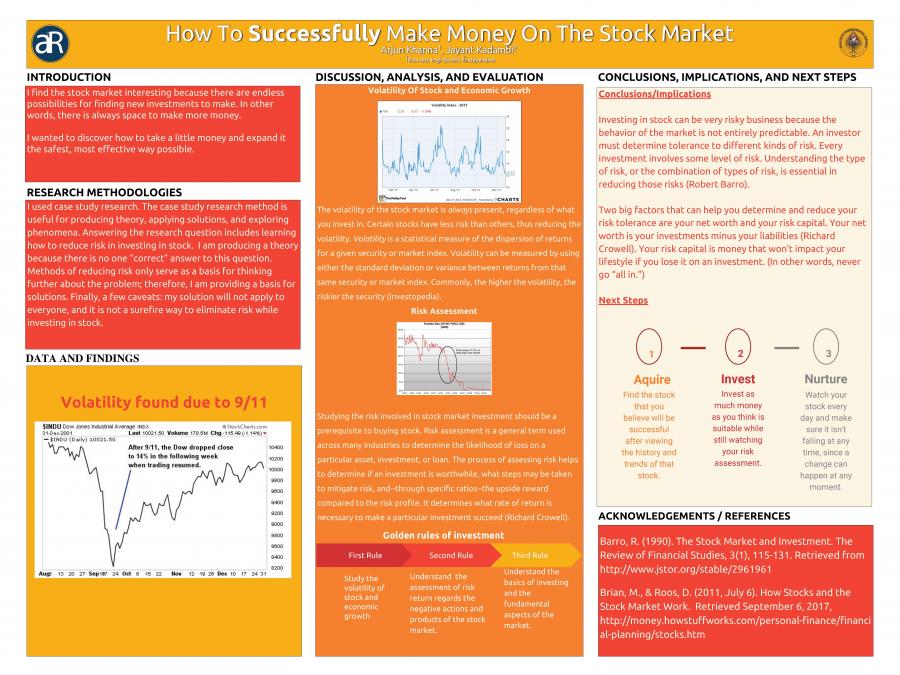

Summary

When you buy stock, you become a shareholder, which means you now own a "part" of the company. If the company's profits go up, you "share" in those profits. If the company starts doing well, you start earning money. However if a company starts to do badly, you can lose money. My project will examine how to invest into companies effectively by analyzing their growth and identifying and reducing risk. Investing in stocks can be a very risky business because it is very unpredictable, especially when outside global factors (2008 Lehman Brothers collapse, 9/11, etc.) occur. Determining tolerance to different kinds of risk is essential. Every investment involves some level of risk. Understanding the type of risk, or the combination of types of risk, is essential in reducing those risks. Two big factors that can help determine and reduce risk tolerance are net worth and risk capital. Net worth is investments minus liabilities. Risk capital is money that, if lost on an investment, won't impact the investor's base lifestyle.