The Effect of Marginal Income Tax Rates on the GDP of the U.S. from 1997 to 2017

Summary

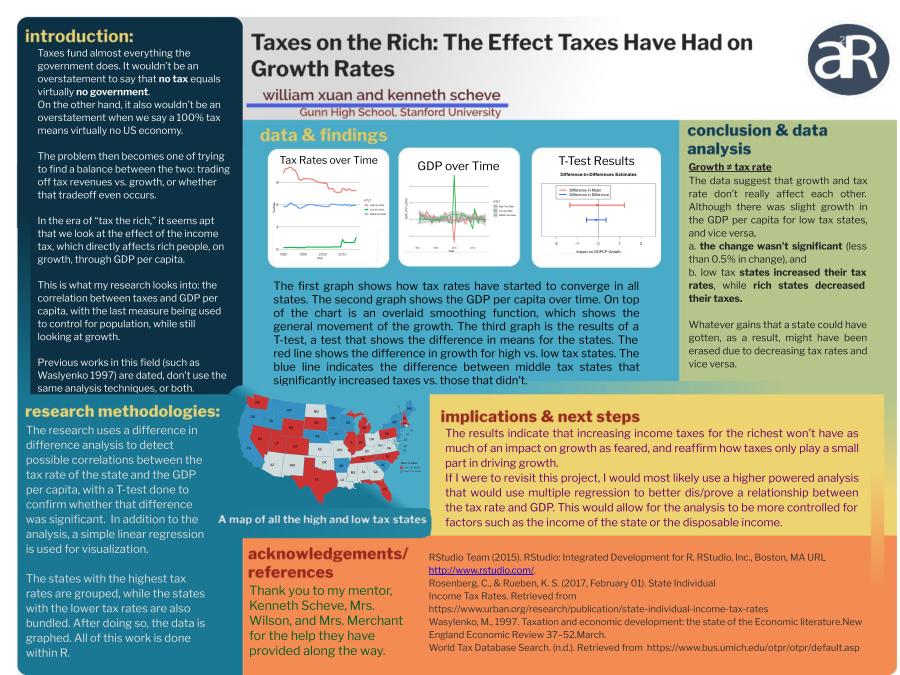

Taxes fund many vital services and infrastructure, such as education and roads. The question is how much tax can be raised without sacrificing growth--or taxes will even cause a loss of growth at all. This project looks at the impact of these taxes on a good measure of the economy, the GDP.